YOU'RE 18...

Now What?

A guide to your legal rights and responsibilities as an adult.

EMPLOYMENTWAGES

When you work full time, you should be receiving at least minimum wage, which is currently $11.00 per

hour. Full time employment is 40 hours, and if you are paid hourly, overtime of 1 ½ of your hourly wage

should be paid for additional hours. If you are not receiving appropriate compensation, or if you have

additional questions about your wages, you should contact an attorney specializing in labor and employment

law or the New Jersey Department of Labor and Workforce Development, Office of Wage and Hour

Compliance at (609) 292-2259.

EMPLOYMENT

Your workplace should be safe and free from exposure to harmful chemicals or contaminants. There are

federal and state laws to help insure your safety. Further, if you do suffer an injury arising out of your

employment, the New Jersey Workers’ Compensation Act is in place to insure that you are provided employerauthorized

medical treatment to cure the effects of your injury at no cost to you. In the event that you are

temporarily unable to work while receiving medical treatment, you are entitled to receive 70 % of your gross

weekly wages, up to the state maximum, which is determined yearly. Furthermore, you are entitled to

payment for your permanent residuals from that injury. Should you have questions regarding an injury arising

out of your employment, you should contact an attorney specializing in workers’ compensation or the New

Jersey Department of Labor and Workforce Development, Division of Workers’ Compensation at (609) 292-

2515.

JOB SECURITY

In New Jersey, unless your employment is governed by contract, you are an at-will employee. This means

that you can leave your job, or that your employer can terminate your employment without cause, unless the

termination violates a legal statute. Union contracts usually protect an employee from at-will termination,

providing that an employee’s termination can only occur in accordance with the disciplinary rules of the

contract. Further, be sure to review your employee manual, should one exist, as this may also provide

contractual rights. Additionally, if you are a highly specialized, highly desirable, or highly paid employee,

you may have the opportunity to negotiate an employment contract for yourself.

It is unlawful to terminate certain employees under particular circumstances pursuant to statutes governing

discrimination. These statutes make it unlawful to fire an employee based on certain personal characteristics,

such as race, national origin, age, sex, religion, handicap or disability, marital status, pregnancy, sexual

orientation and HIV status. It is also unlawful for an employer to terminate an employee for reporting an

employer’s violation of the law, for filing a claim for workers’ compensation benefits, for wages, or for

asserting a discrimination claim. For any questions or concerns regarding these issues, you should contact an

employment attorney or the New Jersey Division on Civil Rights at (609) 292-4605 or the Equal Employment

Opportunity Commission (EEOC) at (609) 984-1096.

UNEMPLOYMENT

In the event that you are laid off or terminated from your job, you may be eligible to receive unemployment

benefits. This generally does not apply if you are terminated for gross misconduct, if you resign, or leave

your job voluntarily. An exception to ineligibility for voluntary resignation may be applied if you can

demonstrate that there was good cause forcing you to leave. If you lose your job, it is best to contact your

local unemployment office to determine if you are eligible for benefits. Once this is determined, application

can be made online at www.lwd.dol.state.nj.us.

STATUTE OF LIMITATIONS

Should you have questions about or think you have a legal claim regarding any aspect of your employment,

you should immediately consult with an attorney specializing in those actions, ie: a workers’ compensation

attorney for a workplace injury or an employment attorney for unlawful termination or discrimination, etc.

REMEMBER – you are limited in the amount of time you have to report an injury or misconduct, as well as

limited in your time in which you may file legal action. If you do not appropriately report the incident or

circumstances and file the legal action within the requisite time frames, you will be forever barred from filing

the claim or receiving compensation for your injury or claim.

INTERNET SAFETY

If you have recently turned 18, you have grown up with the Internet on every computer, phone, tablet or other

electronic device. You are used to pointing, clicking, tapping and having information, communication, sales

transactions and music at your fingertips. You need to understand a few things about the Internet from the

criminal and civil liability perspectives, as well as for your own personal safety.

First, law enforcement officials have broad powers to intercept electronic communications. With various

warrants, if law enforcement has probable cause that you are involved in criminal activity, they can search

your text messages, photos, contacts, call log records, computer, emails and more. Other statutes relate to

pornography, particularly involving children, and provide for serious penalties including imprisonment. Do

not engage in practical jokes, cyber bullying, or hacking of sensitive sites, and be wary of with whom you are

communicating electronically. There are a large number of reported suicides by young people over practical

jokes that started online. Please consider these very serious repercussions before you decide to send messages

over the Internet that could be interpreted as triggering any of these laws.

Next, as a legal adult, you can enter into and be held liable for contracts. Read carefully the licensing

agreements and other legalese before you rush to "click to accept." These are contracts. The best legal

advice is to proceed with caution and make sure you understand what you are reading and signing, even

electronically.

Also, be aware of what constitutes defamation - saying something negative about someone that is false, or is

true, but taken out of context and puts someone in a false light. If you defame someone online or publicly,

you can be sued in appropriate circumstances, even in another state.

Intellectual property is the right people have in their names and brands (trademarks); creative expression, like

songs, books and some papers (copyright); and ideas, like products or designs (patents). Sharing things you

download from the internet, like music, may implicate copyright law and expose you to penalties.

Finally, your own personal safety is an important consideration when using the Internet as frequently as we all

do. In fact, we have become so reliant upon the Internet that we don’t give our Internet safety much thought.

However, we cannot ignore the fact that the Internet is a vast, and often, anonymous place. You really never

know with whom you are communicating. Be wary of requests to meet and other suggestions for contact or

sending money. These requests come via email, online advertisements, bulletin board threads, dating sites

and more. There are a lot of scams out there. Use your judgment and if you are unsure or uneasy, terminate

communication or ask for help.

CONSUMER RIGHTS

CONTRACTS

Contracts are legal and binding upon individuals who are 18 years or older. Contracts can include any loan,

applications for credit, or to buy goods and services.

There are two different types of contracts, written and implied. It is important that, before you sign a contract,

you read the entire document and understand what you have read. Once you enter into a contract, you cannot

later attempt to cancel that contract by arguing that you did not read it or understand the contents.

Federal law provides that a person has a right to cancel a contract to buy goods or services valued at $25.00 or

more under the following circumstances:

1. The contract was made with a salesperson in the home; or

2. The contract was made at any place other than the salesperson's normal place of business; and

3. The buyer gives a written notice of cancellation within three business days of when the contract was

signed (notice can be made by mail, or if that is too slow, by hand delivery or telegram).

It is not necessary to give a reason for the cancelation.

Once the right to cancelation is exercised, the salesperson must return the money within ten days. The

salesperson may pick up the product if the contract involved the sales of goods. If the salesperson does not

pick up the product within 20 days of the date of cancelation, the consumer may either keep it or discard it.

In all situations, the vendor or contractor is responsible to advise the consumer, in writing, of the cancelation

provision. Failure to do so will result in the cancelation period running from the time the consumer is advised

of the cancelation correctly.

The only exception is with regard to home repairs. The cancelation provision in this type of instance is not

applicable to repairs made in an emergency.

CREDIT CARDS

The new Credit Card Act, signed into Law by President Obama in August, 2009, indicates that you must 21

years old to apply. If younger, you must have a co-signer over the age of 21 years old. Applying for your first

credit card may help you develop responsible financial management skills and may eventually open a door to

more financing options. Look for low interest rates.

When applying for a credit card, a review of your credit report is important.

When you apply for credit, credit card issuers are not permitted to discriminate against you because of your

gender, race, religion, nationality, age, marital status or whether you receive public assistance. The credit

card issuer, however, can deny your credit card application if you don't meet the legal age for getting a credit

card. Credit card issuers cannot deny your credit card application because you receive public assistance and

they are to permit you to include public assistance in your income.

Within 30 days of application, a credit card issuer must tell you the result of your credit card application. If

your application is denied, they must provide you a reason and provide you 60 days to determine why your

application was turned down. You are entitled to a free credit score if your credit card application is denied

or if you're approved, but for less favorable terms.

CREDIT CARD BILLING

Once you are able to obtain a credit card, you will be billed upon usage. Credit cards have to mail you a

billing statement at least 21 days before your payment due date, enough time for you to make your payment

on time and take advantage of a grace period, if you have one. Not all credit cards have grace periods. Your

billing statement will include credits and charges to your account since the last billing statement. It will also

include your minimum payment, the due date and information about late payment penalties, as well as the

impact of making the minimum payment.

If there is an error, you have the right to dispute the billing errors. If your credit card statement has an error,

you generally have 60 days to dispute the error with the credit card issuer. Though many credit card issuers

will take a dispute over the phone, you should make your dispute in writing to ensure your rights are fully

protected under the law.

If your credit card is used without your consent, you can reduce your liability for the charges by taking certain

actions. First, you should report your credit card as missing as soon as possible. Any charges reported, if

your card has been stolen, will not be your responsibility if charges by an unauthorized individual appear after

that report. Unfortunately, you may still be liable for up to $50.00 if you're late in reporting the loss. You

are not liable at all for charges made using your credit card number when you still have the credit card in your

possession.

CREDIT REPORTING

A credit report provides details about your credit card and your payment history. Credit card issuers report

your activity to the credit bureau, also called a credit reporting agency or credit bureau. You have the right

to view your credit report and make sure the information reported about your credit card is accurate. You can

dispute any inaccurate information with the credit bureau or the credit card issuer.

CHANGES TO YOUR CREDIT CARD AGREEMENT

Credit card issuers sometimes make major changes to your credit card agreement, like increasing your interest

rate or introducing a new annual fee. You have the right to reject these changes and pay off your credit card

under your current terms. The credit card issuer has to send you a 45-day advance notice before a major

change takes place. They must also give you instructions on how to opt out of these changes.

If you feel your rights as a credit card holder have been violated, you can file a complaint against a credit card

issuer. The Consumer Financial Protection Bureau is responsible for enforcing laws for the credit card

companies. For now, continue to send complaints about debt collectors and credit bureaus to the Federal

Trade Commission. Several different agencies regulate credit card companies, like the National Credit Union

Administration.

BANK ACCOUNTS

Bank accounts are important, providing a place to safely store your money and allowing you to take control of

your own finances. Being 18 years old allows you to open your own individual bank account. Although it

may seem overwhelming, banks make it easy to open an account. One of the most important features of

having a bank account is, if your account is in good order, you will be able to build your credit and make future

financial transactions much easier.

When deciding to open a bank account, compare account features among other banks. Each bank has different

standards when it comes to opening a new account. To find out what fits with your needs, you should visit

the banks in your area. Review the costs and the requirements when opening a checking account and find out

about special offers.

A checking account is a type of bank account which permits you to write checks, pay with a debit card, as well

as cash or deposit your paychecks. Please note that a debit card is not equivalent to a credit card. When you

use a debit card, you are withdrawing money directly from your checking or savings account by making that

purchase. When you use a credit card, you are using funds from a bank or organization that issued you the

card. Each purchase is essentially made with a loan that you repay later. Once you've chosen the bank, you

should make a request to set up a new checking account. You will speak with an account representative.

Bank tellers usually do not set up new accounts.

They will ask you to provide two forms of identification. Generally, you are to provide a driver's license and

Social Security card, but your bank may accept alternatives.

You will also be asked if you'd like to order checks. The bank will provide you with a set of starter checks.

Starter checks do not have your name or address printed on them and, as a result, most businesses will not

accept them. Once you have your account information, you can order checks from your bank or from a private

company.

Checks will come with a check register, also known as a checkbook. Use this register. It is important that

you write down every transaction that you make with your account. This will help prevent from overdrafts.

An overdraft occurs when you spend more money than you have in your account. Every time you over draft

your account, the bank will charge you a penalty fee and, most importantly, this will damage your credit.

If you write a check for funds that are not in your bank account, the bank will notify you that there are

insufficient funds to cover your check. This is commonly known as writing a bad check. If you write a bad

check, the law presumes that you had no account with the bank from which you wrote the check or the payment

on the check had been refused by your bank for lack of funds. It is further presumed that you failed to deposit

enough money to cover the check within ten days after receiving the notice of lack of funds. It is a criminal

charge, the degree of which is based on the amount of the overdraft.

There are also civil damages as a result of issuing a bad check. If sued in civil court for issuing a bad check,

the court may order that you pay the amount of the check and other court costs, fees and attorney fees, not to

exceed $500.00.

BANKRUPTCY

Bankruptcy is where a person is unable to repay the debts that it owes to creditors. There are different types

of bankruptcies. Describing each one is beyond the scope of this article, but it does allow an individual to

remove the burden of excessive debt.

WHAT CAN A BANKRUPTCY PERMIT A PERSON TO DO?

1. It makes it possible to eliminate legal obligations to pay most of your debts. This is called a

"discharge" of debts.

It would stop debt collection calls, harassment, lawsuits and other similar credit actions.

Some of the disadvantages of bankruptcy consist of:

LOSS OF PROPERTY:

There will be effects on your credit and reputation. A bankruptcy will be part of a debtor's credit history as

long as the law allows, which is ten years under the Fair Credit Reporting Act. That means that anyone who

requests a credit card report will be informed that a bankruptcy had been filed. The effect of this will have

future consequences on other credit card applications.

POSSIBLE DISCRIMINATION AFTER BANKRUPTCY:

Usually the problem of reputation is that of discrimination against debtors who had filed for bankruptcy. To

a large extent, the bankruptcy law would alleviate this problem. Government bodies generally may not

discriminate on the basis of bankruptcy or because of a debt discharge in bankruptcy. Unfortunately, the

distinction between discrimination based in bankruptcy or discharge of debts and discrimination based on

future financial responsibility are often blurred. In other words, even creditors who may not be able to

discriminate based on bankruptcy could refuse new credit or other services as long as their refusal is based on

other concerns.

There are debts that cannot be discharged in bankruptcy such as student loans, family obligations and specific

taxes.

RENTING APARTMENT/HOUSING

Before signing a lease make sure you inspect the property and make sure that the property has a Certificate

of Occupancy (C.O.) if the town requires it. You can call the town inspector to see if a C.O. is required.

LEASE:

This is a contract (agreement) between a landlord and a tenant for the rental of a dwelling unit. You should

make sure you have a written lease, and before you sign it read it carefully.

TERMS:

The lease should include a time frame (year, month, etc.); if there is not a time frame mentioned it is

automatically a month to month tenancy.

The lease should state the amount of rent you agree to pay.

The lease may include late charges, if applicable – which means you will be charged a late fee if your rent is

not paid by a certain date.

The lease should include provisions for a security deposit. The security deposit cannot exceed one and onehalf

month’s rent. Make sure to ask for a receipt, which should include the date, the landlord’s signature and

the amount of the deposit. The money is required to be put in a separate, interest-bearing account. The Landlord

must notify you in writing of the name and address of the bank, as well as the interest rate.

As the tenant, you will have exclusive possession of the dwelling unit. The landlord is only allowed to enter

the unit for the following reasons: if you, as the tenant, invite him or his workers in; if the landlord is

conducting an inspection (which must be at reasonable intervals and reasonable times, with notice); if he

landlord or his worker needs to do necessary repairs or emergency repairs.

EVICTION:

Tenants can only be evicted for cause and there are more than 18 different “causes’ including: nonpayment of

rent, disorderly conduct, damage or destruction of property and violation of the landlord’s rules and

regulations.

An exception to the eviction for cause, and where the law does not apply, is when you are residing in a house

with 3 or fewer units and where the owner lives in one of the units; This is known as owner-occupied.

A landlord cannot lock you out of your unit without an order for eviction from a superior court Judge. A

constable (officer from the Court) must be present for an eviction to be legal.

Also, it is against the law for a landlord to hold or take your clothing or furniture in an attempt to force you to

pay your rent.

What should you do “if” you are locked out by the landlord? Immediately call the police and hire an attorney.

ENDING YOUR LEASE:

Make sure to give proper notice in writing; look at lease for the requirements. If you do not give written

notice in the required time, the lease will renew itself automatically “at least” on a month to month basis.

When this occurs, the terms and conditions of the expired lease carry over. If it’s a yearly lease, you usually

have to provide 30 days notice before the end of the lease term. If it’s a month to month tenancy, you must

give at least one month notice, in writing, before the month starts and you can then move out at the end of

the month.

RETURN OF SECURITY DEPOSIT:

Within 30 days after you move out, the landlord must return your security deposit, plus interest, less any rent

you owe or any charges for repairing damage that you have done. The landlord must send a list of the

damages to you by registered or certified mail and must return any money left over.

Keep in mind, the landlord can only charge for property damage that is more than ordinarywear and tear.

Ordinary wear and tear includes faded paint, loose tiles, window cracks caused by weather and the like.

If the landlord does not return your security deposit you can file a complaint against the landlord in small

claims court.

You have access to Legal Services statewide by calling the toll-free hotline at (888) 576-5529.

AUTOMOBILES

NEW JERSEY AUTO INSURANCE REQUIREMENTS

All vehicles registered in New Jersey require three types of mandatory insurance:

Liability insurance pays others for damages that you cause if you are responsible for an accident. It does

not cover medical expenses.

Personal injury protection (PIP) pays medical expenses if you or other persons covered under your policy

are injured in an automobile accident. Often called No Fault coverage, it pays your medical expenses if you

were or were not at fault.

Uninsured motorist coverage protects you if you are in an accident with someone who doesn’t have proper

insurance coverage.

Please Note

If you do not have any liability coverage, you are responsible for paying for

the pain, suffering and other personal hardships and some economic damages,

such as lost wages, that you cause. The insurer will not provide or pay for a

lawyer to represent you if you are sued. Your assets will be at risk, including

the risk of having money deducted from your wages if a judgment is entered

against you. And, if you lack coverage and someone hits you, you cannot sue.

REQUIRED DOCUMENTS:

Your insurance company must give you a New Jersey insurance identification card for each vehicle under your

policy. N.J.S.A. 39:3-29.

You must keep the card in the vehicle and present it:

- Before an inspection;

- When involved in an accident;

- When stopped for a traffic violation;

- When you are stopped in a spot check by a police officer.

Failure to present the card may result in fines.

Driving an uninsured vehicle may result in fines, community service, license suspension and insurance

surcharges.

Auto insurance helps protect you and your family from losses resulting from motor vehicle

accidents. It is required in New Jersey. If you drive without insurance, you are breaking

the law!

What’s in a Policy?

Insurance policies use terms that may be unfamiliar to the average driver. It is useful to

understand what these terms mean so you can make better, more informed decisions about

your coverage.

COVERAGES:

Your auto insurance policy is divided into different coverages based on the type of claim that will be paid to

you or others. (A claim is a request to an insurer for payment or reimbursement of a loss covered by the terms

of an insurance policy.) These coverages are:

Personal Injury Protection – Otherwise known as “PIP”, this is your medical coverage for injuries you (and

others) suffer in an auto accident. PIP pays if you or other persons covered under your policy are injured in

an auto accident. It is sometimes called “no-fault” coverage because it pays your own medical expenses “no

matter who caused the auto accident”. PIP has two parts – (1) coverage for the cost of treatment you

receive from hospitals, doctors and other medical providers, and any medical equipment that may be needed

to treat your injuries; and (2) reimbursement for certain other expenses you may have because you are hurt,

such as lost wages and the need to hire someone to take care of your home or family. You may purchase both

parts of PIP coverage or medical treatment coverage only, depending upon your needs.

Liability – This coverage pays others for damages from an auto accident that you cause. It also pays for a

lawyer to defend you if you are sued for damages that you cause.

There are two kinds of liability coverage. Bodily injury and Property Damage.

Bodily Injury Liability Coverage – Pays for claims and lawsuits by people who are injured or die as a result

of an accident you cause. It compensates others for pain, suffering and economic damages, such as lost

wages. This coverage is typically given as two separate dollar amounts: (1) an amount paid per individual;

and (2) an amount paid for total injuries to all people injured in any one accident that you cause.

Property Damages Liability Coverage – Pays for claims and lawsuits by people whose property is damaged

as a result of an auto accident you cause.

Uninsured Motorist Coverage – Pays you for property damage or bodily injury if you are in an auto accident

caused by an uninsured motorist (a driver who does not have the minimum level of insurance required by

law). Claims that you would have made against the uninsured driver who caused the accident are paid by

your own policy. Uninsured motorist coverage does not pay benefits to the uninsured driver.

Underinsured Motorist Coverage – Pays you for property damage or bodily injury if you are in an auto

accident caused by a driver who is insured, but who has less coverage than your underinsured motorist

coverage. When damages are greater than the limits of the other driver’s policy, the difference is covered by

your underinsured motorist coverage.

Collision Coverage – Pays for damage to your vehicle as the result of a collision with another car or other

object. Collision coverage pays you for damage that you cause to your automobile. You can also make a

claim under your own collision coverage for damage to your car from an auto accident you did not cause.

This may take less time than making a property damage liability claim against the driver who caused the auto

accident. Your insurer then seeks reimbursement from the insurer of the driver who caused the auto accident.

Comprehensive Coverage – Pays for damages to your vehicle that is not a result of a collision, such as theft

of your car, vandalism, flooding, fire or a broken windshield. However, it will pay if you collide with an

animal.

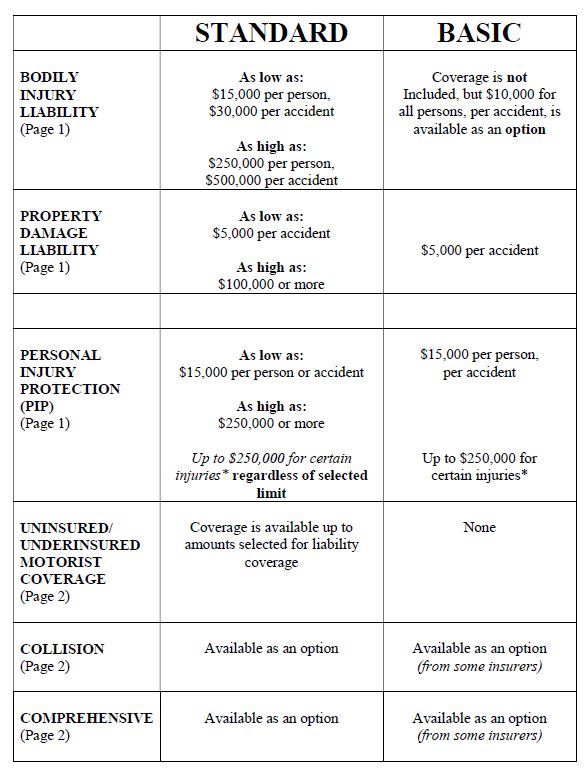

The chart compares the differences between the Standard and Basic policies and explains

the amounts of coverage you may be able to purchase from an insurer.

*permanent or significant brain injury, spinal cord injury or disfigurement or for medically necessary treatment

of other permanent or significant injuries rendered at a trauma center or acute care hospital immediately

following an accident and until the patient is stable, no longer requires critical care and can be transferred in

the judgment of the physician.

CHOICE AS TO RIGHT TO SUE:

There are two choices:

Unlimited Right to Sue – Under the No Limitation on Lawsuit Option, you retain the right to sue the person

who caused an auto accident for pain and suffering for any injury.

Limited Right to Sue – By choosing the Limitation on Lawsuit Option, you agree not to sue the person who

caused an auto accident for your pain and suffering unless you sustain one of the permanent injuries listed

below: (Choosing this option does not affect your ability to sue for economic damages such as medical

expenses and lost wages.)

-loss of body part

-significant disfigurement or significant scarring

-a displaced fracture

-loss of a fetus

-permanent injury (Any injury shall be considered permanent when the body part or organ, or both, has not

healed to function normally and will not heal to function normally with further medical treatment based on

objective medical proof.)

-death

ALCOHOL & DRUGS

ALCOHOL

The legal drinking age in New Jersey for alcoholic beverages, including any liquor, beer and wine, is 21. It

is also against the law for anyone under 21 to enter a bar or liquor store to purchase alcoholic beverages or to

have someone purchase it for them. The penalties for possession or consumption of alcohol by a person over

18, but under 21, are a fine of at least $500, jail time and a potential driver's license suspension if a motor

vehicle is involved.

Be aware that any criminal charges could result in the loss of any awarded financial aid or scholarship money.

DRUGS

It is against the law in New Jersey to loiter to obtain, possess, possess with the intent to distribute, or distribute

any controlled dangerous substance (CDS). This includes marijuana and prescription medication (yours or

someone else's). It is also unlawful to possess drug paraphernalia, including pipes or syringes. In addition

to fines and terms of imprisonment up to 20 years for certain crimes, there are also heavy monetary penalties

imposed, depending on the type and quantity of drugs involved. A conviction for a CDS-related offense or

crime may result in the loss of your driving privileges, even if a car was not involved.

In recent years, Ocean County has seen a record number of overdose deaths. Heroin, fentanyl and prescription

drug abuse are rampant. If you or someone you know has a substance abuse problem, contact someone for

help, and in the event of an emergency call 911.

DRINKING AND DRIVING

It is illegal to operate a motor vehicle under the influence of alcohol or drugs. "Operation" has been interpreted

to encompass more than driving your car and can be inferred from the surrounding circumstances. You are

legally under the influence if your Blood Alcohol Content (BAC) is .08% or higher as determined through an

Alcotest or blood draw. You may also be charged with refusing to submit to a test. Whether you are under

the influence may also be determined through an officer's observations, such as the smell of alcohol,

improbable responses to questions, the observation of alcohol containers, erratic driving, slurred speech and

watery, bloodshot eyes, to name a few.

The penalties for driving while intoxicated are severe in New Jersey. For a first offense where the BAC is

.08% but less than .10% there are fines, penalties and surcharges, 12 to 48 hours in the Intoxicated Driver

Resource Center (IDRC), up to 30 days in jail and license forfeiture until installation of an ignition interlock

device. For a first offense where the BAC is over .10%, there are increased fines, penalties, surcharges, 12 to

48 hours in the IDRC, up to 30 days in jail and the potential of increased license loss and installation of an

ignition interlock device. For a second offense there are increased fines, penalties, surcharges, a jail sentence

of 2 to 90 days (including 48 hours in the IDRC), 1 to 2 year loss of license, the installation of an interlock

device and 30 days community service. For third and subsequent offenses, the offender faces increased fines,

penalties and surcharges, 180 days jail (up to 90 days may be served in IDRC), 8 year loss of license and the

installation of an interlock device.

In addition to the above penalties, if you are under the age of 21 and have a BAC of at least .08%, you will

received an additional loss of license, community service and hours in the IDRC.

If you are found driving during a period of license suspension for your second or subsequent DWI, or if your

license was suspended for your first DWI and it is your second or subsequent time driving while suspended

for that first offense, the penalty is a mandatory 180 day jail sentence.

A DWI has some serious effects on your insurance premiums, as well. You will receive insurance points and

see increases of up to three times your usual premium.

Driving under the influence is reckless, expensive and can cost you or someone else their life.

CRIMINAL LAW

So you're finally 18. You can vote, drive and serve in the United States military. You will also be treated

like an adult if you are arrested for a violation of the criminal laws of this State. Under appropriate

circumstances, a law enforcement officer can make an arrest with or without an arrest warrant. An officer

may also use whatever force is necessary, including deadly force, to make that arrest. If an officer is placing

you under arrest, it is illegal to resist, whether you believe the officer is right or wrong. A law enforcement

officer can also conduct a search with or without a search warrant, if one of the many exceptions to the warrant

requirement applies. When an officer gives you an order, it is unlawful to ignore that order, again, whether

you think the officer is right or wrong. Also remember that not knowing the law is not a defense.

As an adult, you are entitled to be advised of your rights if you are arrested. This includes your right to an

attorney and your right to remain silent. Any statements you make to the police will be used against you in

court as evidence. If you are charged with a crime, you may face significant penalties, which often include

jail and prison. When you face a "consequence of magnitude" like incarceration, a significant monetary fine

or the loss of your driver's license, you have the right to be represented by an attorney. If you cannot afford

an attorney, one will be made available to represent you.

In 2017, New Jersey reformed its bail system. Monetary bail is now rarely used to guarantee your appearance

at court proceedings. If you commit an eligible crime, you will be charged on either a complaint summons

or a complaint warrant. If you are charged with a crime on a complaint warrant you will be taken to jail

pending a first appearance before a Judge. The State may ask the court to hold you in jail pending a final

resolution of your case. After considering a variety of factors, the court will determine whether to grant the

State’s request to detain you. If you are released from jail, the court will impose certain conditions to

guarantee your appearance and Pretrial Services will monitor you until your case is finalized. Keep in mind,

domestic violence crimes, including assaults and violations of restraining orders, require a mandatory arrest

on a complaint warrant and you will be sent to county jail pending a first appearance, which takes place within

48 hours of your arrival.

EXPUNGEMENT:

When you turn 18, any criminal conviction you receive will become part of your permanent criminal record.

Under certain circumstances, you may have your criminal record expunged. An expungement allows for a

conviction to be removed from your criminal record.

ESTATE PLANNING

There are three documents that are essential for any simple estate plan: a Last Will and Testament, Durable

Power of Attorney, and an Advanced Directive for Healthcare . The latter two are the most important while

an individual is still alive.

A Last Will and Testament is a document wherein an individual will dictate how their estate will be distributed

upon their death. The document only comes into effect upon an individual’s death. The document can also

be changed at any time, so long as an individual maintains their testamentary capacity. If an individual does

not have a Last Will and Testament, their estate will be distributed pursuant to Statute. In other words,

according to how the lawmakers believe it should be distributed. A Last Will and Testament can be very

simple or very complex, depending on the size of the estate and the complexities of their life. This document

can also direct where an individual would like their minor children to reside if both parents predecease the

child and how the minor child will be cared for financially.

A Durable Power of Attorney is a document that allows another individual to handle your affairs, in your

place, while you are alive. You as the “principal” assign an “agent” to act in your place and manage all of

your affairs as if you were managing same yourself. This document only survives so long as the principal is

alive. This document is durable, which means that it is still valid even if the principal becomes disabled or

incapacitated. The principal can revoke or revise this document at any time so long as the principal maintains

capacity to make such changes. If the principal loses capacity, the document remains in effect until the death

of the principal or by Court order. A Durable Power of Attorney can go into effect immediately after it has

been executed or can be springing, which means it goes into effect after a specific event occurs.

When a principal is choosing an agent, that agent should be a person that the principal trusts implicitly, as the

agent will have access to all of the principals most personal information and all of their financial holdings.

An agent cannot do the following for a principal; create, edit or revoke a Last Will and Testament, contract a

marriage, vote, or change insurance beneficiaries. If an individual does not have a valid Durable Power of

Attorney and an individual becomes incapacitated, a guardianship proceeding has to be implemented in the

court to appoint a guardian to manage the individual’s affairs. Guardianships are very complex, time

consuming and expensive. The individual also does not have the ability to choose their guardian, as the court

makes the ultimate decision.

The final document of a simple estate plan is the Advanced Directive for Healthcare or more commonly

known as a Living Will. This document will dictate the type of medical care you wish to receive, or not

receive, in the event that you become incapacitated and cannot give consent for yourself. This document is

only valid during your lifetime and only comes into effect if you lack capacity to make your own medical

decisions. The individual that a person names to make their decisions is called a “medical proxy.” It is

important to choose a medical proxy that will carry out your medical wishes. Sometimes the person that you

are closest too is not the right choice because it can be too emotional for them and they may fail to act according

to your wishes. The directive is a guide or outline for the medical proxy to follow so he or she can act in your

place to make the best medical decision for you, given your medical condition. So long as the individual has

capacity, this document can be revoked and revised at any time. This document terminates upon the

individual’s death.

The latter two documents are the most important estate planning documents because they dictate what will

happen to an individual’s financial and medical affairs while he or she is still alive. It is important to maintain

control of your well-being in the event you no longer are capable of managing these affairs on your own. All

of these documents require specific components to make them valid. Accordingly, it is important that an

individual consults with an Estate Planning Attorney before executing any of these documents to ensure all of

your wishes will be carried out while exploring all of your individual and unique circumstances.

A Last Will and Testament is a document that dictates how an estate will be distributed upon one’s death.

A Durable Power of Attorney is a document wherein a principal appoints an agent to manage their personal,

financial and medical affairs during the principal’s lifetime.

An Advanced Directive for Healthcare is a document that names a medical proxy to make medical decisions

on an individual’s behalf when the individual lacks capacity to do so on their own. This document provides

a guide or outline as to the individual’s wishes, within which the medical proxy can act.

FAMILY LAW

MARRIAGE RIGHTS AND RESPONSIBILITIES

You should be aware that should you elect to enter into a marriage, you and your spouse will be bound to over

2400 rights and responsibilities. It is highly advisable that you seek legal advice about such rights and

responsibilities prior to entering into a marriage.

In addition, you and your spouse may elect to enter into a Prenuptial Agreement before your marriage to

determine what will happen legally should a divorce ensue. Such agreements should be reviewed and signed

by attorneys and have very meticulous rules that should be followed if you and your spouse elect to enter into

such agreements.

Further, you should be aware that changes were recently made to the Alimony Statute which you should be

familiar with prior to entering into a marriage.

There are several different types of alimony (spousal support) which a party could be required to pay at the

termination of a marriage. Permanent alimony has been replaced with “Open Ended” alimony, which could

be reduced or terminated at the time of the payor’s retirement, based upon certain factors. This eliminates

permanent alimony. Further, there are now certain regulations which govern when a modification or reduction

of support may be appropriate based upon a loss of income.

Based upon these changes, and the various rights and responsibilities that you will be contracting into upon

marriage, an attorney can guide you and educate you fully about the impact of a divorce, given your particular

circumstances. Many matrimonial attorneys offer free or low cost consultations and can provide valuable

information to you so that you are fully informed prior to entering into a marriage contract.

GETTING MARRIED

Once you turn 18, you do not need your parents’ permission to get married. However, just because you can

doesn’t mean you should! Marriage is a huge commitment and not to be taken lightly so think before you act.

Before you can get married, you will need to secure a license from the clerk of the town in which the bride

resides. It cannot be issued more than 72 hours after you apply and is valid for only 30 days from the actual

date issued.

New Jersey does not recognize common law marriages and we do not have “legal separations.” Common

sense will also tell you that you cannot marry a blood relative, including your cousin. The ceremony can be

performed by anyone authorized by the state to do so, which can include clergy members, mayor, judge, etc.

DIVORCE

If you need to end your marriage, you need to file a Complaint for Divorce in the county in which you reside.

New Jersey is a “no fault” state and it does not matter why you want to end the relationship, as fault has no

impact on what either party is entitled to receive. Whatever you and your spouse accumulated during the

marriage is distributed through what is called equitable distribution, whether it is an asset or a debt. Any

debts in your own name will most likely end up being your own responsibility unless you can prove it was

accumulated for marital purposes. Depending on the length of the marriage and disparity in incomes, one of

you may be required to support the other by paying alimony. How much and for how long depends on many

criteria which are set forth by statute.

CUSTODY AND CHILD SUPPORT

The majority of parents share joint legal custody, with one parent being designated the Parent of Primary

Residence (PPR) and the other the Parent of Alternate Residence (PAR). Both parents share in major

decisions concerning the health, education and welfare of the child.

Child support is based on your combined joint gross incomes and is calculated using the Child Support

Guidelines, which is a computer program which uses specific information to calculate the amount of support

to be paid. By law, it is paid by wage garnishment and through Probation. Support is paid until the child is

emancipated, which, in New Jersey, means over the age of 18, graduated high school and is not enrolled in

college. If a child goes to college full time, meaning 12 credits a semester with a “C” average, child support

continues to be paid. In addition, both parents may be required to contribute to the costs of college after the

child has applied for all scholarships, loans, grants and used their own savings and earnings. If you and the

other parent cannot agree on your contribution, you can seek the court’s assistance for that determination.

If paid through the Child Support Enforcement Unit of the Probation Department, child support terminates

when the child turns 19 years of age, unless the child is a full time student, has special needs, or the parties

have agreed to a different termination date. Child support cannot continue to be paid through Probation pas

the child’s 23rd birthday.

DOMESTIC VIOLENCE

This is a serious problem throughout the United States. Victims can file a complaint and secure a Temporary

Restraining Order (TRO), which orders various relief, such as no contact, seizure of weapons, custody and

support. A TRO is entered based on the testimony of only the Plaintiff (the person filing). A return date is

normally scheduled for 10-14 days after the TRO is granted and at that time both parties (Plaintiff and

Defendant) have the opportunity to testify and present witnesses. If a Final Restraining Order (FRO) is

granted, it is a permanent order that never goes away unless the Plaintiff dismisses it or the Defendant is able

to have it dismissed by the Court.

If the FRO is granted, the Defendant will be finger printed and photographed and there is a mandatory penalty

that must be paid. If the Defendant is charged with violating the FRO and is found guilty, there is the potential

for jail time and further financial penalties.

The domestic violence law applies to household members, spouses, persons who have a child together or are

having a child and to persons who have a dating relationship. In addition to the matter being in Family Court,

there is also the potential for criminal charges to be filed.

VOTING

REGISTRATION AND QUALIFICATIONS

To vote, you must be a citizen of the United States, 18 years old by the time of the next election and must be

a resident of your county for at least 30 days before the next election. If you are in college, you have the option

to register from your college address or your parents’ address.

You are not permitted to register to vote if you have been convicted of an indictable offense (state or federal)

and are serving your sentence, or presently are on probation or parole. You are also not eligible to register to

vote if a court has determined that you lack the capacity to vote. You must register to vote at least 21 days

prior to an election.

You may register to vote by mail or in person. To register in person, you can go to the municipal clerk’s office,

the county commissioner of registration’s office and some libraries. You can find out the location of where

you can register in person at Elections.NJ.gov., the NJ Division of Elections, or the League of Women Voters

of New Jersey.

You may register by mail, as well. You may obtain the voter registration form online at Elections.NJ.gov, or

you can pick up a form at a voter registration agency. In addition, when you first obtain a driver’s license, or

you are renewing a driver’s license, you will be asked if you wish to register to vote.

To complete your registration form, you will need to provide identification information to prove who you are.

If you have a driver’s license, you must provide the driver’s license number. If you have a non driver’s

identification card, you must provide the number. If you do not have either, you need to provide the last four

digits of your social security number or must sign a section of the form affirming that you do not have any of

these forms of identification.

Also, to prove your identity if you do not have a driver’s license, you may provide a non-driver’s identification

card, a student or employment identification card, military identification card or other government

identification card, store membership card, or any document that has the person’s name and current address

on it (bank statement, car registration, pay check, government check, or rent receipt).

HOW TO VOTE

Voting is either done via paper ballot or voting machine. We do not have the ability to vote online, as of yet.

To vote in person, you go to your designated polling location (the designations are available online through

NJ Division of Elections Polling Place search), you will sign the poll book and the voting authority slip, they

will provide you with one part of the voting authority slip and you will hand it to the worker stationed at the

polling machine. Then you will enter the machine alone, unless you are visually impaired or disabled, and

place your vote(s.)

You can also mail in voting ballots. To mail in a vote, you must file an application (which you can obtain

online and print out) with the county clerk. You can apply by mail no later than 7 days before the election, or,

in person, up to 3:00 p.m. the day before the election. After that time, you must apply to a court for an

emergency mail-in ballot.

After you apply to vote by mail, a ballot will be sent to you, which you complete and mail back. Anyone can

choose to vote by mail; you do not need a reason.

MILITARY SERVICE

Federal Law requires that all male U.S. Citizens born after December 31, 1959, who are 18 but not yet 26

years old, must register with the Selective Service. A male turning 18 must register with the Selective Service

within 30 days of their 18th birthday. The mail may register online at www.sss.gov if he has a Social Security

Number. A male can register by completing the registration forms at your local U.S. Post Office.

After your registration is complete, you will receive proof of registration. You should keep it some place very

safe so if you are required to provide proof of registration, it will easily be accessible. Failure to register for

the Selective Service is a violation of the Law and could result in criminal penalties.

Additionally, those who do not register with Selective Service will not qualify for Federal Student Loans or

grant programs or Federal Aid or Federal employment. Any questions concerning Selective Service

registration should be addressed to www.sss.gov or by calling the Selective Service System at (888)655-1825.

Disclaimer: The presentation and materials provided today and available on the Ocean County

Bar Association website are for informational purposes only and not for the purpose of providing

legal advice. You should contact your attorney to obtain advice in respect to any particular legal

issue or problem.

ACKNOWLEDGEMENTS

The Ocean County Bar Association wishes to acknowledge the Committee Members and Editors

who compiled the information presented and contained on this outline and full brochure which

can be found at our website www.oceancountybar.org.

2020 Contributors

Laura M. Halm, Esq. - Coordinator

Lauren Staiger, Esq. - Coordinator

Lisa Adams, Esq.

Christine L. Matus, Esq.

Jared Monaco, Esq.

Jamie L. Schron, Esq.

Founding Committee Members

Stacie A. Brustman, Esq.

Claire M. Calinda, Esq.

Maryanne Calvetto, Esq.

Laura M. Halm, Esq.

Eugenia Lynch, Esq.

Christine L. Matus, Esq.

Marianna C. Pontoriero, Esq.

Jamie L. Schron, Esq.

Richard Sevrin, Esq.

Terrance L. Turnbach, Esq.

Original Editors

Stacie A. Brustman, Esq.

Claire M. Calinda, Esq.